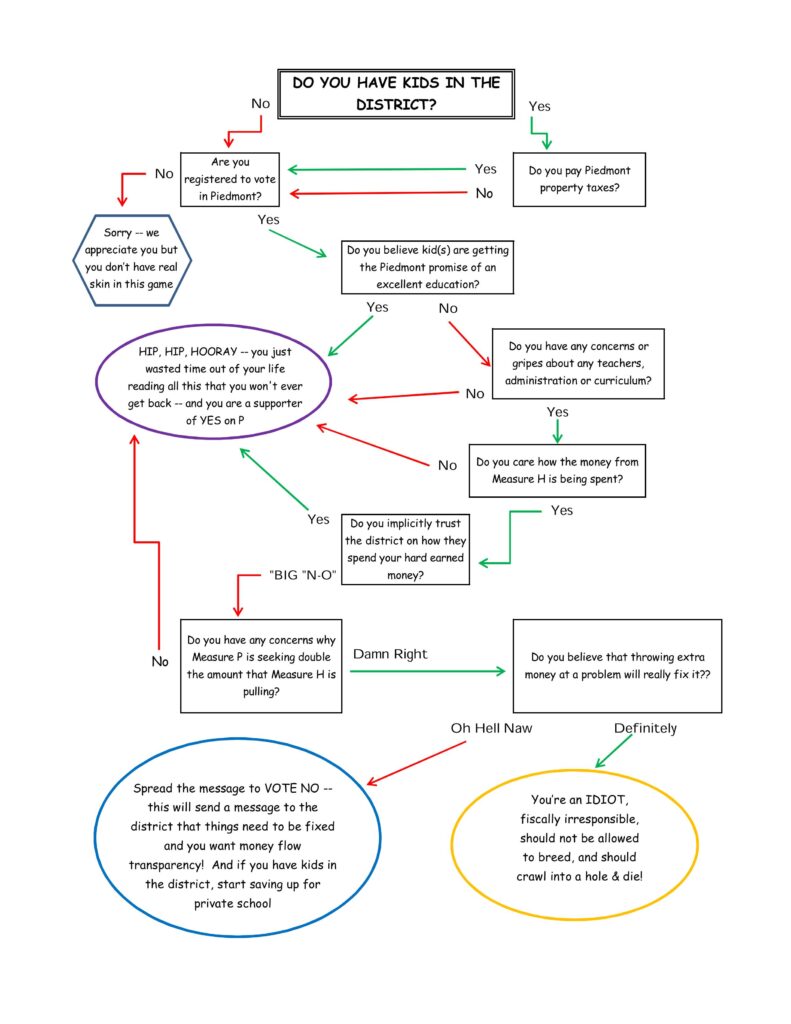

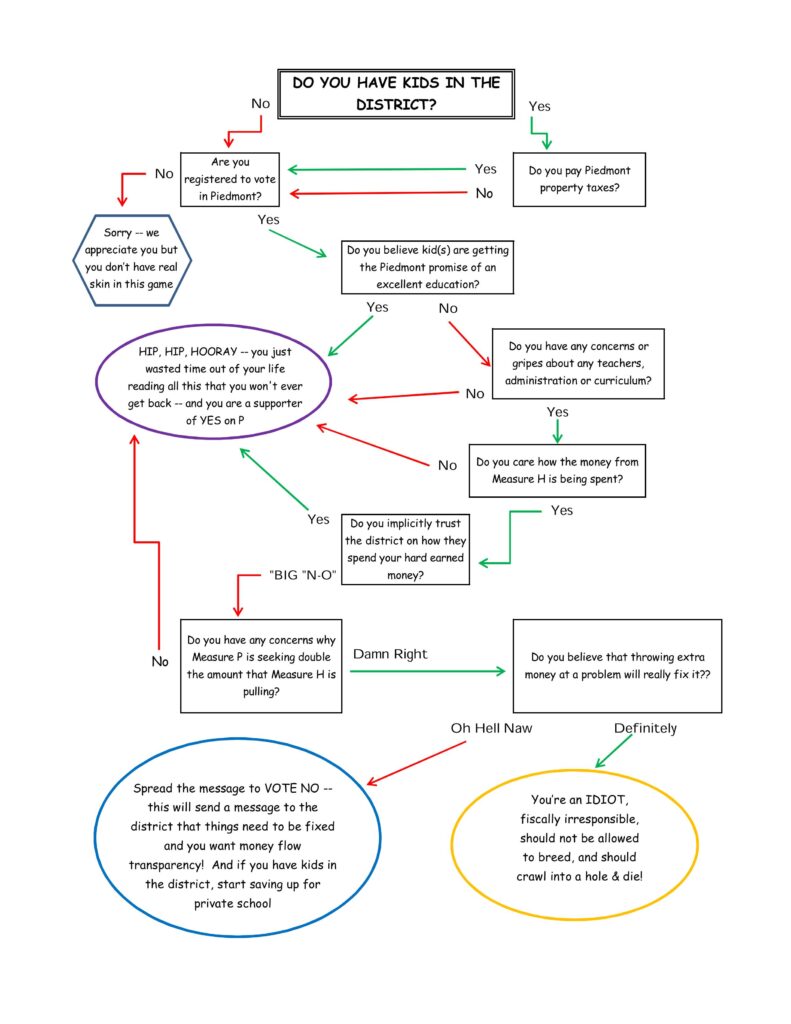

Are you YES – or – NO for Measure P?

Here is a guide for voters to evaluate Alameda County ballot titles.These ratings are NOT an opinion on the measures, but a rating to promote furtheranalysis of very important initiatives. https://ballotwatchdog.com

From the Alameda County Grand Jury Association: Measure PPiedmont USD Parcel Tax To attract and retain highly qualified teachers and educational support staff and continue funding advanced academic programs, shall Piedmont Unified School District’s measure renewing the school parcel tax for 8 years be adopted at the rate of 50 cents per square foot of…

The Parcel Tax Should Be Entirely Progressive, Just Like It Used to Be The school parcel tax was previously based on home valuation. However, when a court case deemed this method illegal, the school board faced a choice: implement a flat tax or a tax proportional to square footage, which aligns more closely with the…

In recent years, Piedmont Unified has undergone a troubling transformation, one that prioritizes the psychological well-being of students over their academic growth. While the mental health of our students is undeniably important, the current shift raises concerns about the balance—or lack thereof—between emotional support and educational rigor. As a Piedmont parent, I want all students…

Please support Measure P! Measure P replaces Measure H – – which voters approved in November 2019. Measure H levied an annual special parcel tax of $0.25 (twenty-five cents) per square foot of building improvements. Measure H tax is for eight (8) years: from July 1, 2020 to June 30, 2028. Measure H brings in…